The day January 31, 2020 the United Kingdom left the European Union. After 11 months of transition period, finally the day January 1, 2021, this country will no longer be part of the EU for all purposes and this has consequences for trade and treatment of goods and services with that country.

Broadly speaking, what must be taken into account is that as of January 1, sales and purchases of goods and services with the United Kingdom that before Brexit were considered intra-community shipments and acquisitions, will now be considered exports and imports.

From Emiral, we give you a brief summary of the changes that this event entails for the configuration of Microsoft's most powerful ERP, Dynamics 365 (although in AX 2012 the configuration would be very similar)

Dynamics configuration before the changes brought about by Brexit

Sections to take into account:

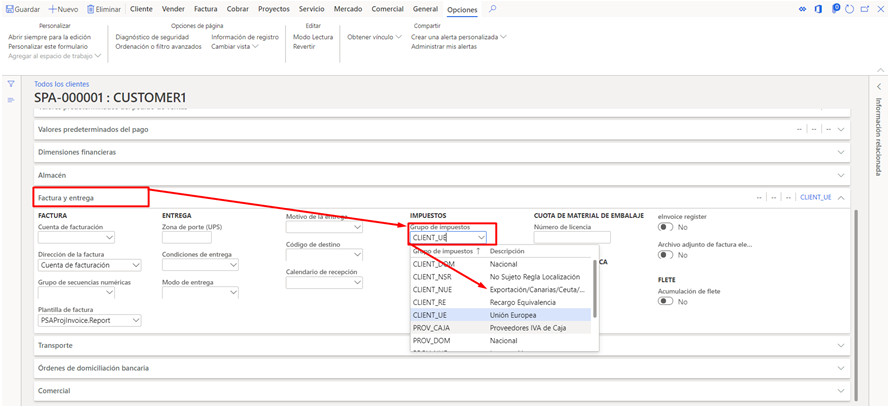

- Clients and suppliers: In this section, two fundamental points must be taken into account; firstly, the group of customers or suppliers and secondly the tax groups that these customers and suppliers are linked to.

- Groups of clients and suppliers: This point is important above all with a view to those companies in which the ledger account associated with these groups. To do this, on the customer and supplier file, you will have to check the group assigned to those belonging to the United Kingdom and modify them where appropriate:

Customers:

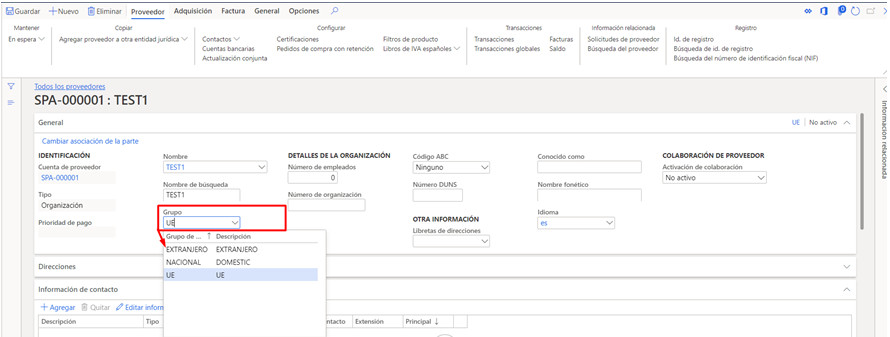

Providers:

Note: If this modification is made, and as mentioned before, the posting profiles they are configured by group of clients, which is usually the most normal, it must be taken into account that only after said change will the system take into account the new accounting account. - Tax Groups: Like the groups of customers and suppliers, the tax groups linked to these UK customers and suppliers are important. In this case, it will be necessary to take into account that those customers and suppliers that were previously considered intra-community, with Brexit now they will be considered foreigners. Normally this change must be reflected with a change in the master of customers and suppliers as follows: Customers, will go from having a group of EU taxes to a group of Export taxes:

In suppliers, it will happen in a similar way, and for suppliers from the United Kingdom, the group of taxes will be modified from EU to Import:

In suppliers, it will happen in a similar way, and for suppliers from the United Kingdom, the group of taxes will be modified from EU to Import:

- Groups of clients and suppliers: This point is important above all with a view to those companies in which the ledger account associated with these groups. To do this, on the customer and supplier file, you will have to check the group assigned to those belonging to the United Kingdom and modify them where appropriate:

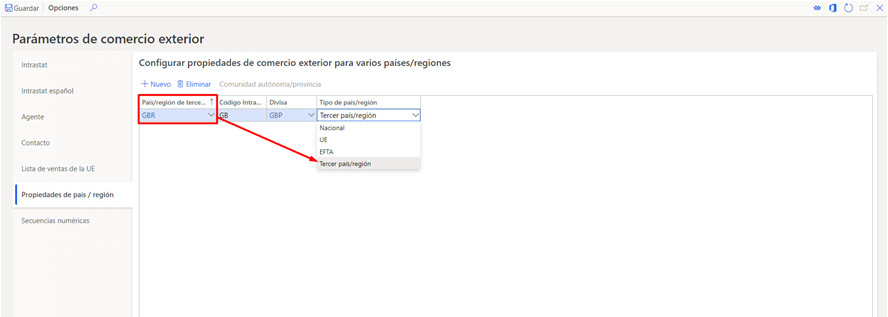

- Country configuration in the Foreign Trade Parameters: in this section that we will access from the route Taxes -> Configure -> Foreign Trade, the United Kingdom will go from being a country EU to a Third country/region.

This parameter will also allow us to make the reports of Intrastat and EU Sales List, no longer take this country into account as a member country of the EU for future exchanges.

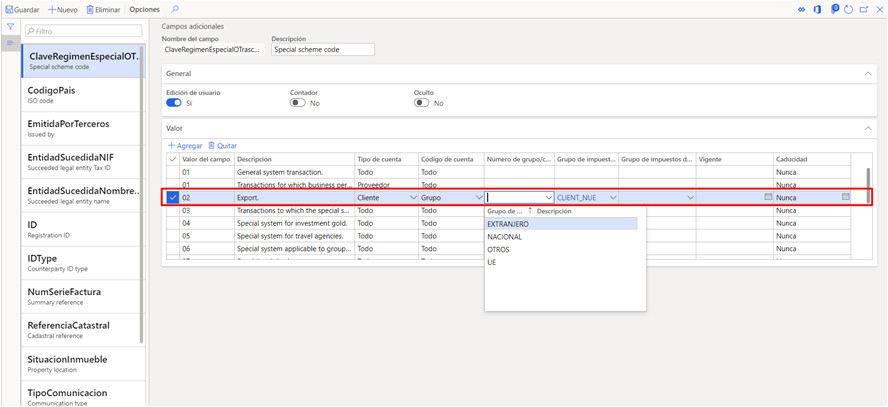

This parameter will also allow us to make the reports of Intrastat and EU Sales List, no longer take this country into account as a member country of the EU for future exchanges. - IBS: In this last section, it will be necessary to take into account that if a configuration has been made in the IBS based on tax groups or groups of customers and suppliers to establish the keys of the special regimes of transcendence, it will be necessary to review said configuration and verify that no change is necessary. To do this we will access the route: Taxes -> Configure -> Electronic Messages -> Additional Fields and on the first section of the Transcendence Special Scheme Password, the configuration for EU and foreign customers will be checked (and if applicable, if there is a specific group for UK customers):

Do you want to implement an ERP in your company?

We help you!

In Emiral We know how much your company is worth, whether it is small, medium or large. For this reason, we want to offer you the best ERP management solutions so that your business continues to grow.